Disney, a titan in the media industry, is reportedly making moves that could reshape its television network portfolio. Word on the street is that Disney is considering selling some of its smaller networks, including Freeform and National Geographic, to A+E Networks.

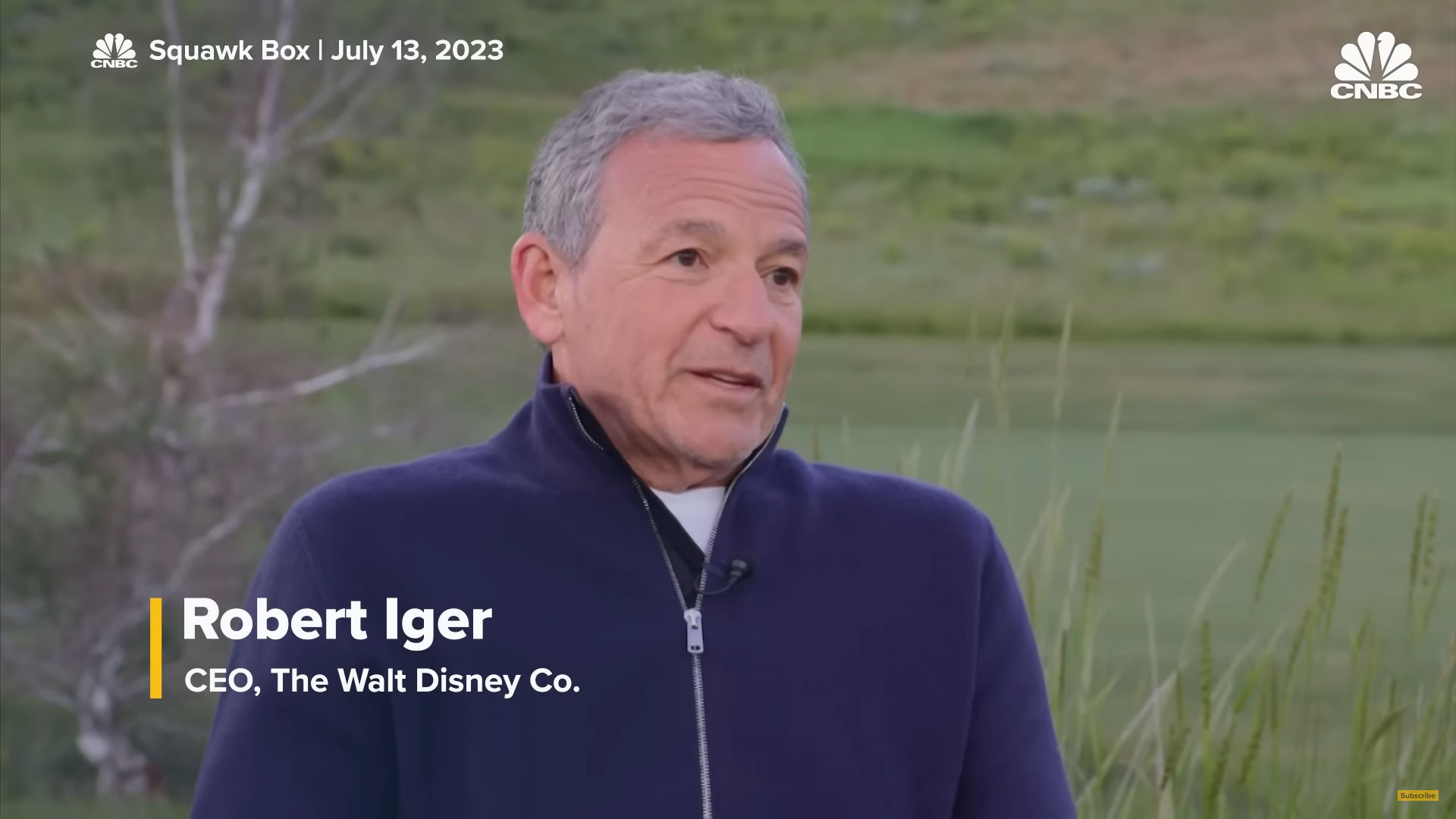

This potential sale is part of a broader strategy to revamp Disney's operations and focus on its most profitable and valuable channels. The company's CEO, Bob Iger, hinted at this possibility in an interview earlier this year with CNBC, where he left the door open to selling some of Disney's TV assets.

Such a decision would align with the company's ongoing review of its cable networks, aimed at identifying which ones line up with its long-term vision and which might be better off under different ownership.

that Disney has completed this review and is now considering a deal with A+E Networks. This deal is intriguing because it would allow Disney to retain partial ownership of the networks being sold, as A+E Networks is a joint venture between Disney and Hearst Communications.